You may also deduct the expenses if they're considered deductible expenses.

Expenses paid by a tenant – If your tenant pays any of your expenses, those payments are rental income. Advance rent – Generally, you include any advance rent paid in income in the year you receive it regardless of the period covered or the method of accounting you use. Amounts paid to cancel a lease – If a tenant pays you to cancel a lease, this money is also rental income and is reported in the year you receive it. Most individuals operate on a cash basis, which means they count their rental income as income when they actually or constructively receive it, and deduct their expenses when they pay them. Report income on line 8l and expenses on line 24b of Schedule 1 (Form 1040), Additional Income and Adjustments to Income PDF, if you're not in the business of renting personal property. Report income and expenses related to personal property rentals on Schedule C (Form 1040) PDF, if you're in the business of renting personal property. If you provide substantial services that are primarily for your tenant's convenience, report your income and expenses on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship).

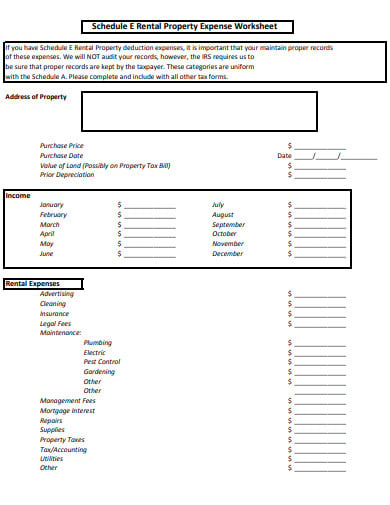

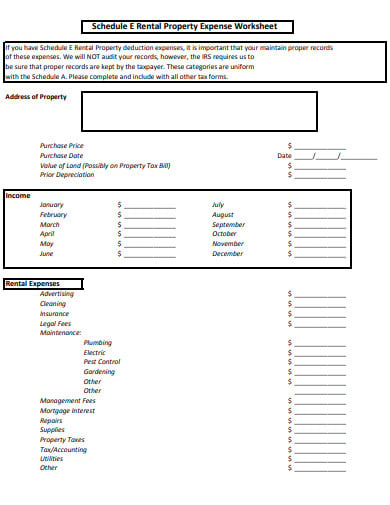

You can generally use Schedule E (Form 1040), Supplemental Income and Loss to report income and expenses related to real estate rentals.In general, you can deduct expenses of renting property from your rental income.

Cash or the fair market value of property or services you receive for the use of real estate or personal property is taxable to you as rental income.

0 kommentar(er)

0 kommentar(er)